By Tad W. Patzek

By Tad W. Patzek

March 16, 2006Corn ethanol is the fuel du jour. It’s domestic. It’s not oil. Ethanol’s going to help promote “energy independence.” Magazines trumpet it as the motor vehicle fuel that comes from the “Midwest rather than the Mideast.” But is it really?

There is plenty of corn, to be sure. American farmers grow about 42% of the world’s output. It’s the single largest crop on earth (the sugarcane crop is larger, but it contains more water). In 2004, U.S. corn output could have fed the entire population of China. However, a mere 2% of U.S. corn goes directly to feed people; another 19% goes into processed foods (e.g., the high-fructose corn syrup additive in almost every processed food product in our supermarkets). The majority of U.S. corn goes to feed livestock, even though corn makes cattle sick and produces antibiotic-resistant bacteria.

These uses still leave mountains of excess corn stashed all over Midwest fields, waiting to rot or be processed into ethanol.

Interestingly, the National Corn Growers Association has been asking every corn grower to lobby Congress to increase domestic production of fossil fuels by opening the Arctic National Wildlife Reserve and the Outer Continental Shelf for exploration and production, and by drilling everywhere on U.S. territory for oil and gas. Why? Because the U.S. agricultural industry depends heavily on natural gas, coal, and petroleum for its existence. Nitrogen derivatives and other fertilizers drive the high yields achieved by U.S. farmers. Corn farming devours about 40% of these fertilizers. Nitrogen fertilizers, accounting for roughly half the total energy input per acre of harvested corn, are made from natural gas that is badly needed for other uses, such as home heating, cooking, and power generation. Today, the U.S. imports 15% of its natural gas and 60% of its oil. Furthermore, it is the world’s largest importer of nitrogen fertilizers, mostly from Trinidad, Tobago, Canada, Russia, and Saudi Arabia.

The farm sector also depends significantly on natural gas and petroleum for transportation, refrigeration, irrigation, crop drying, heating farm buildings and homes, and pesticides and herbicides.

Accounting for the direct costs, roughly 40% of the calorific value of industrial corn grain comes directly from the use of fossil fuels, mostly natural gas, but also coal and petroleum. This grain could be burned in efficient corn stoves to provide home heating for the Midwest, or it could be ground, fermented, and distilled to produce ethanol.

Because corn grain is a nascent, or “baby” fossil fuel, it takes a lot of energy to transform it into ethanol. For example, the best performance guarantee by ICM, Inc. of Kansas, states that a dry-mill ethanol plant will spend an incredible 58% of ethanol’s calorific value on direct distillation and co-product processing costs. If corn or ethanol must be moved from the Midwest to either coast, there is an additional transportation cost of up to 11% of ethanol’s calorific value. An average U.S. refinery uses less than 12% of gasoline or diesel fuel’s calorific value to produce and distribute them. Therefore, it takes from roughly 5 to 12 times more fossil energy to refine corn grain into ethanol than it does to convert crude oil into gasoline or diesel fuel.

Ethanol refineries also use huge amounts of water. An average dry-mill plant needs about 750,000 gallons of processing water per day. Some of this water is recycled, but the rest must be obtained from a local water supply. Clean drinking water is becoming scarce in much of the Midwest, especially across its western area. An average ethanol refinery emits dozens of dangerous chemicals into the air, such as toluene, ethylbenzene, acetone, formaldehyde, acetaldehyde, acrolein, benzene, styrene, and furfural. In line with the current schizophrenic attitude towards ethanol production, the U.S. Environmental Protection Agency has just proposed allowing ethanol refineries to more than double their legal air emissions, from 100 to 250 tons per year.

There are serious questions about the sustainability of corn production. Iowa has lost about half of its 14 inches of top soil to erosion. Fertilizer runoff and farm chemicals have polluted much of the Mississippi River basin, and that runoff flows all the way into the Gulf of Mexico. Over the last 20 years, the runoff from Midwestern corn and wheat fields into the Gulf of Mexico has totaled between 2,000 and 10,000 tons of nitrate per day. Over the next 70 years, thanks to agribusiness and industrial agriculture, the most productive grassland ecosystem on earth may be completely destroyed, neutered by overproduction. As they continue to be degraded, Midwestern fields will have to become larger and be subsidized even more with fossil energy.

Industrial crop production (corn, wheat, soybeans, etc.) causes environmental damage and loss of human health valued at between $5.7 and $16.9 billion per year. The annual hidden subsidies to agribusiness from environmental resources are estimated at $25 to $100 per hectare.

If you compares a corn field with a prairie, the conclusion is that the prairie runs on sunlight, while the corn field runs on fossil fuels. The most eloquent testimony to this effect was given by Theresa Schmalshof of the National Corn Growers Association, before the House Subcommittee on Energy and Mineral Resources in Washington, D.C. on May 19, 2005. She said that corn farmers will “face huge obstacles if our nation cannot come to grips with its desire to have limitless resources, like natural gas, for production and not realize that these resources have to come from somewhere. I am sure the members of the subcommittee as individuals know this well. However, Congress seems unaware of this fact. We can produce corn, but we need you to produce the kind of policy that enables us to use the needed resources to do so.”

Thus corn agriculture is a scheme to launder fossil fuels into an industrial raw material, while damaging the environment of roughly half the continental U.S. land mass, and poisoning most rivers, streams, and coastal waters.

For more on what Patzek has to say, click here.

Read more...

A ruling by an obscure regulatory agency threatens to silence Internet radio. After intense lobbying from the recording industry, the Copyright Royalty Board (CRB) is about to mandate exponential increases — by as much as 1,200 percent — in royalties paid every time webcasters stream a song online.

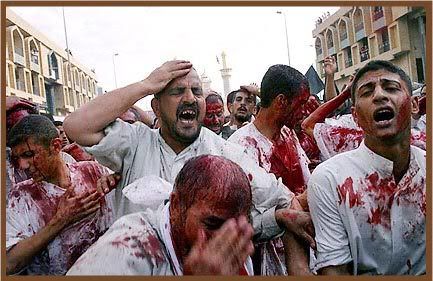

A ruling by an obscure regulatory agency threatens to silence Internet radio. After intense lobbying from the recording industry, the Copyright Royalty Board (CRB) is about to mandate exponential increases — by as much as 1,200 percent — in royalties paid every time webcasters stream a song online. Thanks to high oil prices and hefty subsidies, corn-based ethanol is now all the rage in the United States. But it takes so much supply to keep ethanol production going that the price of corn -- and those of other food staples -- is shooting up around the world. To stop this trend, and prevent even more people from going hungry, Washington must conserve more and diversify ethanol's production inputs.

Thanks to high oil prices and hefty subsidies, corn-based ethanol is now all the rage in the United States. But it takes so much supply to keep ethanol production going that the price of corn -- and those of other food staples -- is shooting up around the world. To stop this trend, and prevent even more people from going hungry, Washington must conserve more and diversify ethanol's production inputs. By Tad W. Patzek

By Tad W. Patzek By Axel Merk

By Axel Merk For the first time in five months, the armed wing of Hamas has fired mortars and rockets into Israel from Gaza, breaking an unofficial truce and a period of relative calm along the border.

For the first time in five months, the armed wing of Hamas has fired mortars and rockets into Israel from Gaza, breaking an unofficial truce and a period of relative calm along the border. By Christian Parenti

By Christian Parenti "Why should I try to convert my non-Muslim friends when I often prefer them to the Muslims that I know? How will being Muslim change their lives for the better if they already display more of the Islamic virtues than most of the Muslims they are likely to meet?"

"Why should I try to convert my non-Muslim friends when I often prefer them to the Muslims that I know? How will being Muslim change their lives for the better if they already display more of the Islamic virtues than most of the Muslims they are likely to meet?"

Thanks to our nation's income tax system, individual Americans are not free--they are literally on parole.

Thanks to our nation's income tax system, individual Americans are not free--they are literally on parole. Is the United States a free country? Not by traditional measures. In the history of Western civilization, freedom has an economic meaning and a legal meaning. More and more, the United States fails both measures of freedom.

Is the United States a free country? Not by traditional measures. In the history of Western civilization, freedom has an economic meaning and a legal meaning. More and more, the United States fails both measures of freedom.